do you pay tax on a leased vehicle

This means you only pay tax on the part of the car you lease not the entire value of the car. Also do leased vehicles require.

Why You Should Buy Your Leased Car Forbes Wheels

The math would be the following.

. The typical annual allowance of 10000 to 15000 miles is stingy and the penalty of 20 to 25 cents per mile for exceeding the limit seems. To determine how much sales tax you will pay over the entire term of the lease simply take the tax amount found in Step 2 and multiply it. The definition of sale includes any transfer of ownership or possession or both in return including the rental or leasing of tangible personal property.

When you lease a car in most states you do not pay sales tax on the price or value of the car. Use tax is due. Sales and Use Tax Introduction.

So if you live in a state with a. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. In leasing you agreed to make a monthly.

Do car lease payments include sales tax. You have to pay a high fee when you drop off the car. Calculate Tax Over Lease Term.

All applicable fees are due at the time of titling by the lessor such as the 15 title fee and the. Instead sales tax will be added to. This would be the payment.

Luckily there is a law in California that if you sell your car within 10 days of buying out the lease you do not. When you buy out your lease. 55167 x 108 59580.

This Directive clarifies the application of the sales and use tax statutes GL. Is there any differential here compared to owning a car in NC. The leased vehicle will be titled in the name of the lessor owner.

If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. Sells the vehicle within 10 days use tax is due only. Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration.

If you are a full. Is it the same cost as paying for property taxes on an owned vehicle vs leased vehicle. Tax is calculated on the leasing companys purchase price.

Titling Your Leased Vehicle. In California the sales tax is 825 percent. 64I and the Departments sales tax regulation on.

The current tax rate of California for purchasing a used car is 725. The most common method is to tax monthly lease payments at the local sales tax rate. If youre considering leasing you may be wondering whether you pay taxes on a leased car.

Article continues below advertisement. Lease Payment Before Taxes x 1 State Sales Tax The 1 represents 100 percent of the payment. A lease buyout which usually occurs at the end of your lease period is when you opt to keep your leased car rather than return it to the dealer.

Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. In Virginia you will be taxed upfront on the cost cap of the rented car 6 sales tax rate Fairfax County and then on the 415 tax rate based on the value of the car each year. The monthly rental payments will include this.

What Should I Expect When I Return My Leased Car Autotrader

How Car Lease Payments Are Calculated The Canada Car Buying Guide

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

5 Reasons Why You Should Buy Your Leased Car Autotrader

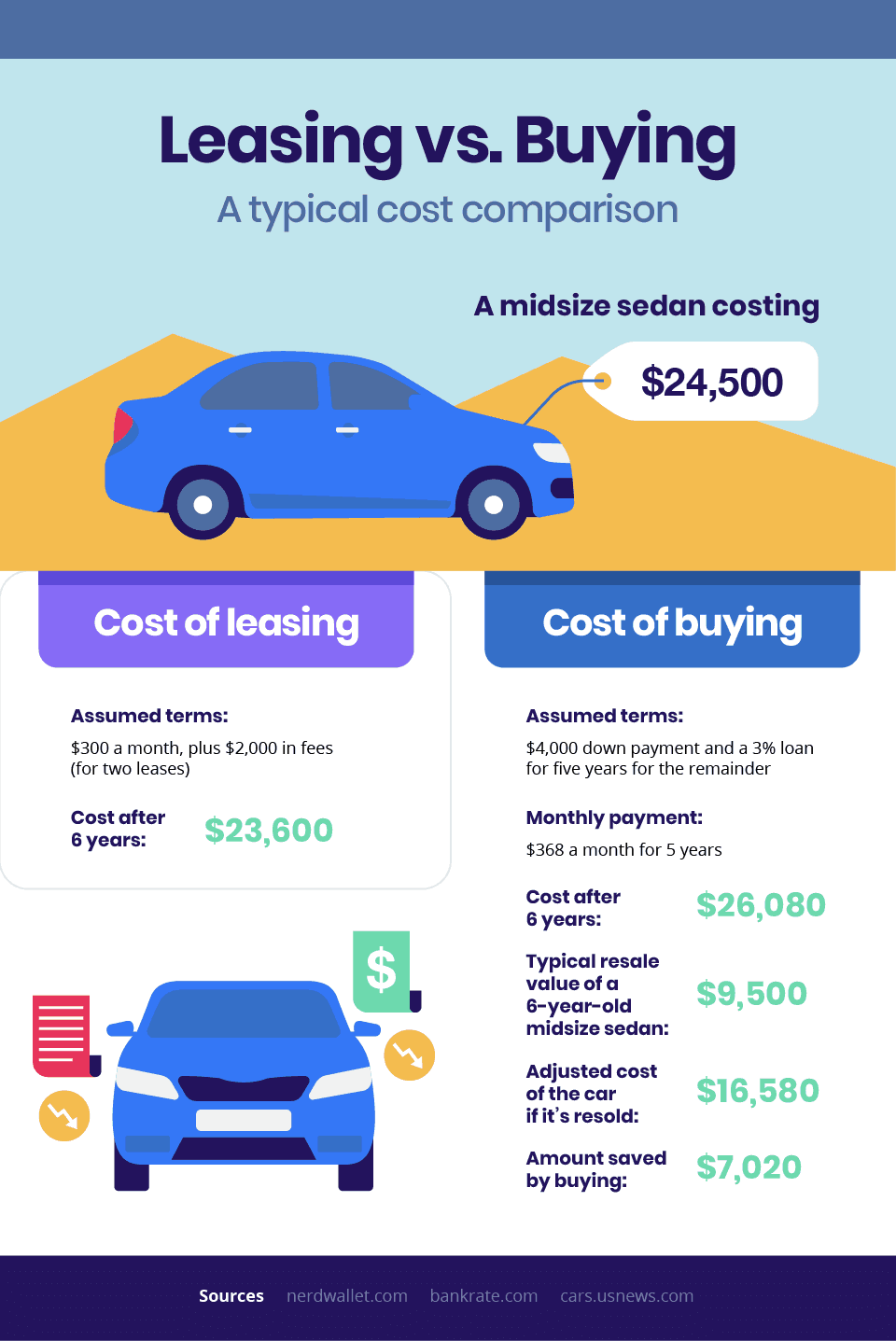

Is It Better To Buy Or Lease A Car Taxact Blog

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Should I Buy Or Lease My New Business Vehicle 2022 Turbotax Canada Tips

4 Steps To Buy Your Leased Car Tresl Auto Finance

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Refinancing A Leased Car The Complete Guide For 2019 Protect My Car

Is It Better To Buy Or Lease A Car Taxact Blog

How Much Canadians Pay On Average Every Month On A Car Lease Leasecosts Canada

Insuring A Leased Vehicle Bankrate

How To Calculate Finance Charges On A Leased Vehicle 11 Steps

4 Ways To Calculate A Lease Payment Wikihow

Is It Better To Buy Or Lease A Car Taxact Blog

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)